Earn up to 6%

Dividend Yield*

with no lock up or hassle

*Based on historical actual dividend payments of our selected companies. Computed annual yields are based on estimates and actual yields may vary.

LICENSED BY

A PROUD MEMBER OF

insured by

Securities Investors Protection Fund (SIPF), up to PHP 500,000 cash balance

Powered By

Invest without the stress

Earn up to 6% dividend yield with our Passive Income Portfolio

Based on historical actual dividend payments of our selected companies. Computed annual yields are based on estimates and actual yields may vary.

Be confident in investing

Lowest Fees, Maximum Gains

Keep more of what you earn with our low fees–because every peso counts.

No Lock-Up, No Worries

Withdraw anytime with zero penalties or exit fees–your money, your control.

Fully Managed, Stress-Free

Expert-built portfolios, automated for your. Invest and relax–we handle the rest.

Safe and Secure Always

You own your stocks directly. Cash balances are insured up to PHP 500K.

Getting started is easy

Stay protected and secured

Get startedYour account

full control

We don’t pool your funds–your investments stay in your name, fully transparent and secure.

Secured,

no matter what

If anything happens to us, your stocks remain yours, safe, and transferable. Unused cash is insured up to PHP 500K.

Frequently asked questions

Have a question that is not answered? Contact us at support@aaa-equities.com.ph

A robo advisor is as safe as working with a human advisor and with any kind of advisor, it comes with its own pros and cons. Robo advisors are fully automated so you can expect consistent performance and perfectly monitor your portfolio daily. However, customizations are limited.

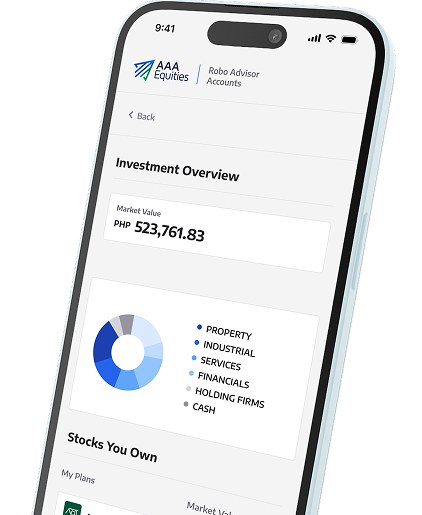

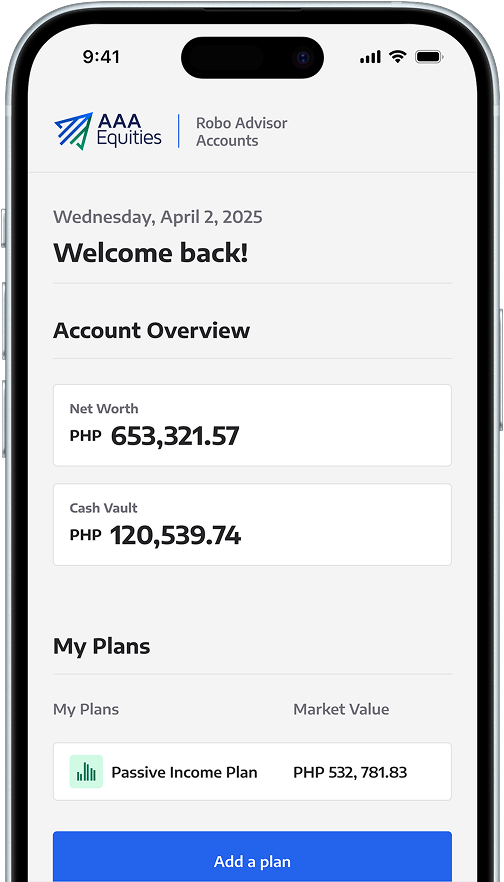

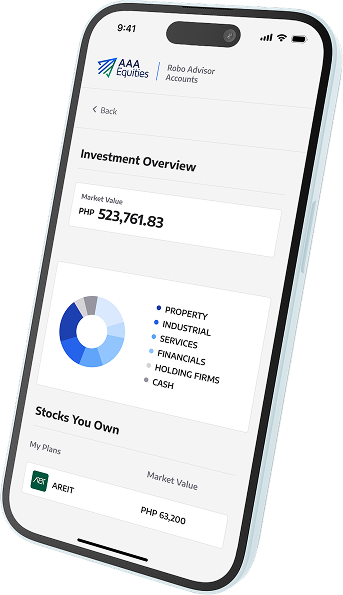

When you create and fund your robo advisor account, you’ll be asked to choose an investment plan or goal and our robo advisor will automate the investing for you. When prices move up or down, the robo advisor will automatically take profits or buy more for your account to keep your investments in-line with your goals. Your dividends are automatically reinvested.

An investment plan is a strategy that has a specific goal it wants to achieve. You will be asked to choose a plan so our robo advisor will know what to invest in. The stocks included in the investment plan are diversified to reduce risk and carefully curated by a team of expert analysts.

Currently, we have our Passive Income Plan. We will be launching more plans in the coming months.

Yes! In a good year, companies may pay higher dividends through special dividends. Additionally, dividends you receive may vary due to price fluctuations and board lot requirements.

Robo Advisor Accounts are designed for investors who want a fully automated portfolio managed for them. Since we manage the portfolio, Robo account holders do not have access to an online trading account but instead have access to a Robo Advisor Account Dashboard. The AAA Trading Account is more suited for active traders who prefer to conduct their own research, analysis, and trade executions.

Yes! If you already have an account with AAA, simply email support to request a Robo Advisor account. Please note that these are two separate accounts with different login credentials.

Yes, just submit a withdrawal request through your user portal and the robo advisor would liquidate just enough of your portfolio to cover your withdrawal request.

While we do our best to pick the best stocks for your account, it’s not risk-free. Stock prices move up and down all the time but our robo advisor is designed to monitor your account daily and adjust it automatically as necessary.

Minimum initial investment would vary per investment plan selected.

Yes, additional investments can be done for as low as PHP 1.00, there is no minimums aside from the initial investment minimum.

Fully Secured Account

100% Transparent and Secure

Withdraw Anytime

No lock up period

Fully managed

AI-powered management