Fully managed portfolios

— just for you!

Our expert built, diversified portfolios help you invest like a pro. Simply choose what's best for you.

What’s a Robo Advisor?

A robo-advisor is a smart investment tool that builds and manages your portfolio using expert-designed strategies and automation.

It’s like having a personal fund manager 24/7—minus the high fees. Our technology helps you grow your money automatically, with expert strategies and zero stress.

Human and algorithms, working together

Our human chooses the best stocks for you

Our in-house team of market professionals conducts through research and carefully select stocks, ensuring you invest only in high-quality companies.

Offer diverse strategies to maximize returns

We’re not limited to just dividend-paying stocks, we also strive to create new investment themes, giving you more ways to build your portfolio and grow your wealth.

Our robos automate everything

Our Robo Advisor algorithm handles everything else, from balancing your portfolio to rebalancing and optimizing it over time. No need for constant monitoring or manual decision-making.

With our smart automation, your investments stay on track, adapting to market changes while you focus on what matters most.

Start investing in stocks the easy way

Get startedUnderstanding investment risks

— and how we manage them

All investments carry some level of risk, including the potential loss of capital.

Even with carefully selected stocks, market prices can rise and fall due to economic conditions, industry trends, or company performance. There is no guaranteed return.

Our Robo Advisor is designed to help reduce these risks.

It monitors your portfolio daily, automatically rebalancing when needed to stay aligned with your goals. While we can’t eliminate market ups and downs, our approach is built for long-term growth and resilience.

What to expect with our Robo Advisor

Expect your portfolio to move up and down daily

Daily market movements are expected. Your portfolio may go up or down depending on factors like sector performance or global events.

The key is staying focused on long-term growth and making informed investment decisions along the way.

Flexibility to switch investments anytime

Easily move your capital between different portfolios—or hold it in cash—until you're ready to reinvest.

You’re in control, with the freedom to adjust your strategy as your goals evolve.

Easy withdrawals within 1–5 Days

Need to access your funds?

- Instant Withdrawal: If cash is available, it’s processed within 1–2 days

- Stock Liquidation: If we need to sell assets, it may take 3–5 days to complete.

All withdrawals are automatically deposited to your linked bank account

Expertly built portfolio without the extra fees

Robo Advisor accounts work similar to mutual funds, but how do we compare?

Frequently asked questions

Have a question that is not answered? Contact us at support@aaa-equities.com.ph

A robo advisor is as safe as working with a human advisor and with any kind of advisor, it comes with its own pros and cons. Robo advisors are fully automated so you can expect consistent performance and perfectly monitor your portfolio daily. However, customizations are limited.

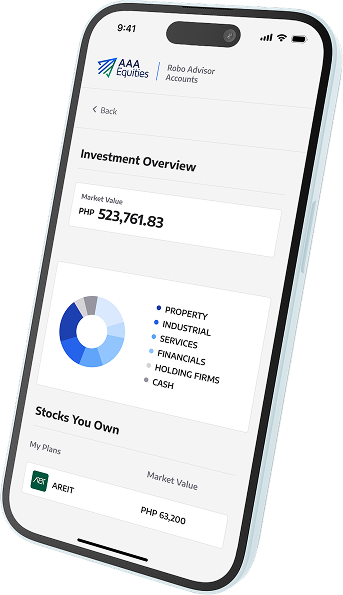

When you create and fund your robo advisor account, you’ll be asked to choose an investment plan or goal and our robo advisor will automate the investing for you. When prices move up or down, the robo advisor will automatically take profits or buy more for your account to keep your investments in-line with your goals. Your dividends are automatically reinvested.

An investment plan is a strategy that has a specific goal it wants to achieve. You will be asked to choose a plan so our robo advisor will know what to invest in. The stocks included in the investment plan are diversified to reduce risk and carefully curated by a team of expert analysts.

Currently, we have our Passive Income Plan. We will be launching more plans in the coming months.

Yes! In a good year, companies may pay higher dividends through special dividends. Additionally, dividends you receive may vary due to price fluctuations and board lot requirements.

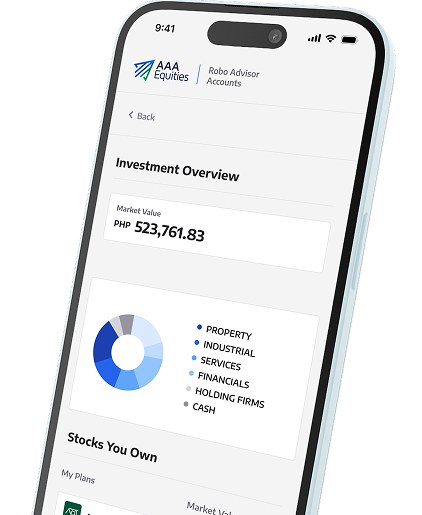

Robo Advisor Accounts are designed for investors who want a fully automated portfolio managed for them. Since we manage the portfolio, Robo account holders do not have access to an online trading account but instead have access to a Robo Advisor Account Dashboard. The AAA Trading Account is more suited for active traders who prefer to conduct their own research, analysis, and trade executions.

Yes! If you already have an account with AAA, simply email support to request a Robo Advisor account. Please note that these are two separate accounts with different login credentials.

Yes, just submit a withdrawal request through your user portal and the robo advisor would liquidate just enough of your portfolio to cover your withdrawal request.

While we do our best to pick the best stocks for your account, it’s not risk-free. Stock prices move up and down all the time but our robo advisor is designed to monitor your account daily and adjust it automatically as necessary.

Minimum initial investment would vary per investment plan selected.

Yes, additional investments can be done for as low as PHP 1.00, there is no minimums aside from the initial investment minimum.

Fully Secured Account

100% Transparent and Secure

Withdraw Anytime

No lock up period

Fully managed

AI-powered management